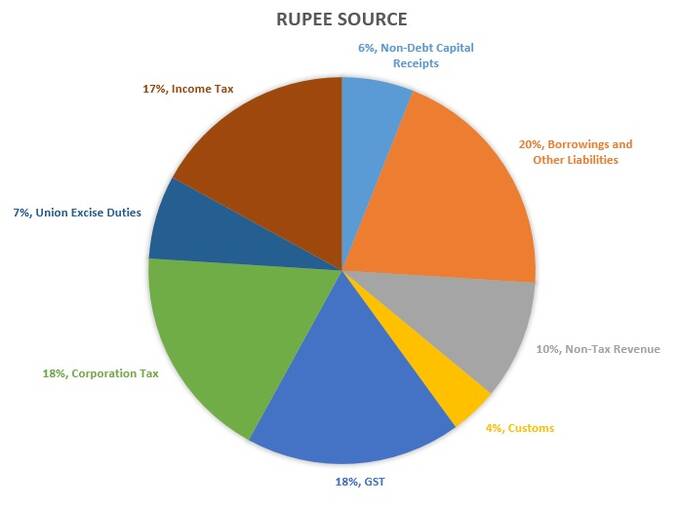

64 paise of every Rupee that the government of India gets comes from various forms of taxes. These include GST (18 paise), Corporate Tax (18 paise), income tax (17 paise), excise duties (7 paise), and customs (4 paise). Borrowings and other liabilities contribute 20 paise to the mix.

The remainder is made up of Non-Tax Revenue (10 paise) and Non-Debt Capital Receipts (6 paise). Non-tax revenue includes dividends from PSUs, interest income, income earned from printing stamps, currency, and income from other services. Non-Debt Capital Receipts (NDCR) includes recovery of loans, proceeds from disinvestment of PSUs, and sale of assets.

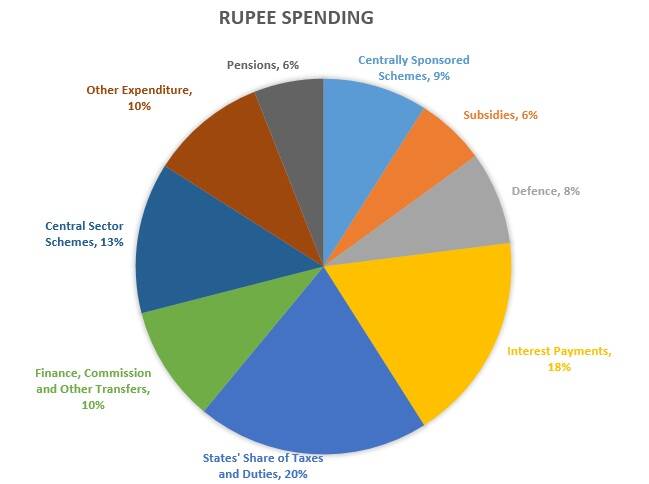

On the expenditure side, states' share of taxes and duties (20 paise) is the biggest single expense head. 18 paise is spent on interest payments. Central Sector Schemes and Centrally Sponsored Schemes receive 13 and 9 paise respectively.

Central Sector Schemes are entirely funded and executed by the central government. Crop insurance scheme, Mudra Yojana, and Namami Gange are some examples. Centrally Sponsored Schemes, on the other hand, are implemented by states but are largely funded by the centre with a defined state government share. MGNREGA, Pradhan Mantri Awas Yojana, mid-day meal programme, and Pradhan Mantri Awas Yojana are examples of such schemes.

Finance commission and other transfers (10 paise), defence (8 paise), pensions (6 paise), subsidies (6 paise), and others (10 paise) constitute the remainder of the spending.