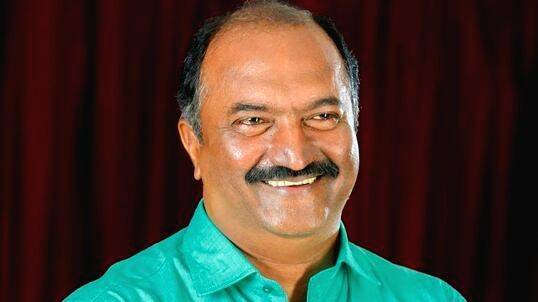

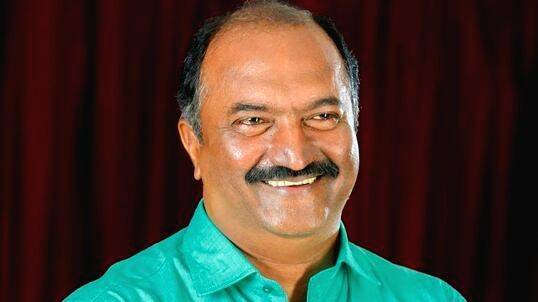

THIRUVANANTHAPURAM: In order to recover from the terrible financial crisis the state is currently experiencing, the government is expected to raise several service charges and taxes in areas that are not subject to the GST in this year's budget. There may be a hike in various service-certificate charges, stamp duty, professional tax, the fair value of land, mutation of property, etc. All these will add more burden to the people. Finance Minister KN Balagopal had indicated that the budget will be a little severe. The budget will be presented on February 3.

The government is also likely to take action to streamline tax collection. The move is to bring a seasonal change in the professional tax rate and slab which was revised 30 years ago. The Finance Commission, chaired by former Chief Secretary Vijayanand, had recommended that this should be increased. It is a major source of income for local bodies. At present, people with a monthly income above Rs 12,000 should pay a professional tax of 1 percent every six months. The advantage is that if the income of the local bodies is increased, the grants and project allocations given to them can be deducted from the government expenditure.

The fair value of land was last revised in 2010. There has been a big change in the market price after that. The hike will be introduced accordingly. The government aims to increase the revenue from registration fees. The fair value reforms committee had submitted its report last September.

With the tax collection schemes not showing significant results, the government will make efforts to improve tax collection by assessing the transactions of traders. It was able to collect only 41 crores last year and 137 crores in the year before through the amnesty scheme, including one-time settlement.

No hike in welfare pension

State revenue

Burden for people

1. Hike in building tax will be a burden for everyone

2. Hike in the fair value of land will affect related sectors

3. Construction of houses will become more costly