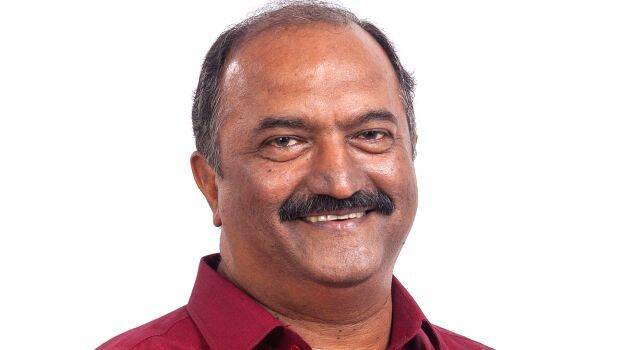

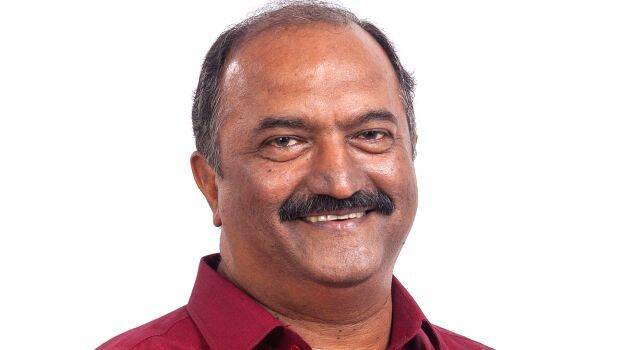

THIRUVANANTHAPURAM: The Kerala assembly passed the Kerala Taxation Rules (Amendment) Bill, 2023 to establish GST Appellate Tribunals in Kochi and Thiruvananthapuram. Finance Minister K N Balagopal told the assembly that although the demand to form a tribunal in Kozhikode has been approved in principle, it cannot be started immediately.

These will function above the departmental appellate system and appeals against their decisions will be considered by the High Court. The Kerala State Goods and Services Tax Act, 2017 was amended based on the amendment made to the Central Goods and Services Tax Act by the Central Finance Act.

A tribunal in the state will consist of two members including a technical member and a judicial member. The judicial member should be a High Court judge. A committee consisting of the Chief Justice of India and the Chief Secretary of any State shall select the judicial members. The Technical Member will be working in the rank of Principal Secretary in the State Service or Additional Secretary in the Central Service.

The central government can issue a notification that the tribunals have come into existence only after amending all the state GST laws. It is only after this that steps will be taken including selection of the committee for selecting the judicial members of the state tribunals. Appellate officers are currently appointed at the level of Joint Commissioner and Additional Commissioner at the first level in the state. Officers in the posts of Joint Commissioner, Additional Commissioner and Commissioner are also working in the Central Government. According to the GST Act, the Appellate Tribunal has to work at the second level above them.