Not many of us will find ourselves without a personal loan. Banks will grant personal loans very quickly with minimum documents provided. However, personal loans have a disadvantage that the interest rate is higher than other loans. Still, many people rely on personal loans for urgent needs.

Know about the features and benefits of personal loans

Factors affecting eligibility for personal loan

Credit score: A credit score is a three-digit number that represents your creditworthiness to a lender. It describes how you have managed your finances and bills in the past. The lower the score, the less likely you are to get a good deal on your loan application.

Monthly Income: As collateral is not mandatory for personal loans, your monthly income and repayment capacity are important. Income requirements vary based on where you live i.e. it may vary across metro cities, tier1 cities, tier2 cities, towns and villages.

Eligibility Criteria: The eligibility criteria for getting a personal loan varies from bank to bank.

Interest rate

Since personal loans are unsecured, the interest rates may be on the higher side. It will help if you opt for a fixed or variable interest rate depending on the bank or NBFC

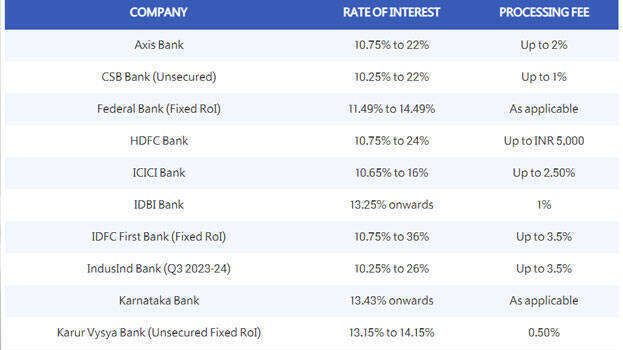

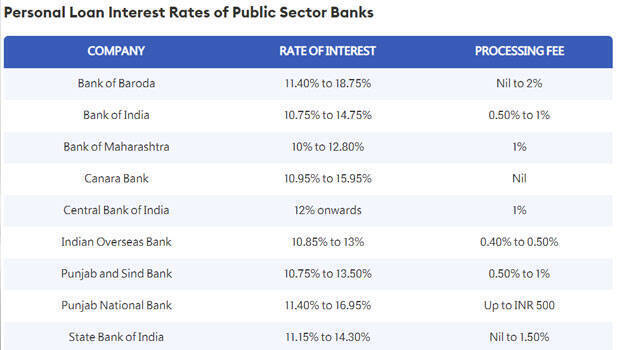

The personal loan interest rates of various banks for the month of March 2024 are as follows-