The incident in which a depositor named Sabu hung himself in front of the Kattappana Rural Development Co-operative Society after being denied the return of his deposited amount for his wife's medical expenses cannot be dismissed as an isolated one. There is a likelihood that such incidents could overshadow all the achievements of the government. Sabu's decision to end his life was not just because he was denied his deposited money but also due to the humiliation and mistreatment he faced from the bank staff. According to Sabu's wife, Marykutty, the bank employees refused to return the money despite repeated requests and even behaved rudely with Sabu. Reports suggest that Sabu was supposed to receive Rs 14 lakh. Sabu had been running a small ladies' centre named 'Variety' in Kattappana.

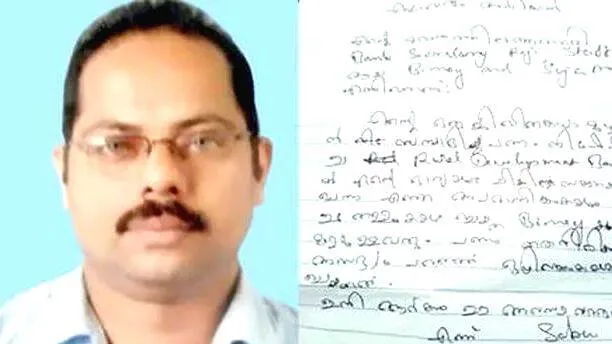

As per the complaint made by Sabu to former bank president VR Saji, an employee named Binoy pushed him away when he visited the cooperative society to demand the return of his money. Sabu also accused Binoy of falsely claiming to have been attacked by him. However, in an audio recording that surfaced today, Saji backed Binoy’s allegations and confronted Sabu over the supposed incident, saying, “It’s high time you need belt treatment. Wait for it, and we will teach you a lesson.” Sabu’s suicide note, found in his pocket by the police, named bank secretary Reji and employees Binoy and Sujamol as being responsible for his death. It is evident that Sabu was not only distressed over the non-return of his money but also deeply humiliated, which drove him to take his life. The note also stated that no one else should face such a fate. This serves as a grave warning to the entire cooperative banking sector in the state.

Despite repeated suicides like this, the crisis in the cooperative sector remains unresolved. The crisis in the cooperative banking sector has been caused by employees and politically affiliated bank officials embezzling crores without the knowledge of depositors. Additionally, the bank's failure to recover large loans granted without sufficient collateral has also contributed to the crisis. Following the news of frauds in cooperative banks such as the Karuvannur Cooperative Bank in Thrissur district and others in places like Kandala and Nemom, depositors began withdrawing their funds in large volumes, pushing most cooperative banking societies into financial distress. The foundation of the banking business is trust. Once that trust is broken, it doesn’t take long for any bank to collapse.

It is tragic that people who have worked hard to earn their money and deposited it in cooperative banks are now forced to plead for its return. It is unacceptable that the very bank officials who enthusiastically collect deposits transform into villains by threatening depositors when they ask for their money back. The government has a responsibility to change this situation where a depositor is compelled to commit suicide just to ensure their family gets the deposited amount. If the government fails to act, the Reserve Bank of India (RBI) should intervene to provide a solution. If these banks cannot return the money immediately, at the very least, their employees should be taught to speak respectfully. The cooperative department must urgently establish a grievance redressal cell to ensure that such suicides are not repeated in the future.