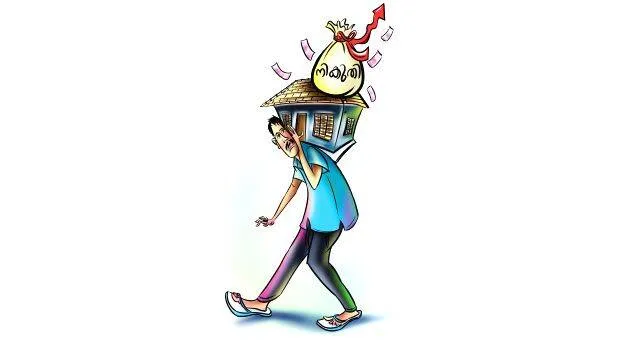

THIRUVANANTHAPURAM: Houses exceeding 538 sq ft (50 sq m) in the state will also be brought within the limit of building tax (property tax). Currently, the tax is levied on houses over 660 square feet. In addition, the Cabinet has approved the recommendations of the sixth State Finance Commission on Local Government with amendments.

For houses between 50 sq m and 60 sq m, the property tax will be half the normal rate. For houses built from April 1 this year and with a floor area more than 3,000 sq ft, an additional tax of 15 per cent will be levied. Property tax reforms in rural and urban areas will be completed by March 31. These should be posted on the website of the local body.

Property tax reform will occur annually from the next fiscal year. The decision to limit the increase in property tax for certain categories of buildings will be withdrawn. The building owner should inform the Local Government Department about the demolition of the building. Otherwise, the tax must be paid by the due date. Basic document should be prepared using GIS system for full detection and collection of tax and non-tax revenue.Local bodies should facilitate electronic payment system.

Along with the annual budget, the local bodies should also prepare an action plan for increasing the rolling revenue. Special team at IKM headquarters to resolve taxpayers' grievances and it should be resolved within hours.