THIRUVANANTHAPURAM: Criminals are devising new tactics for financial fraud via UPI (Unified Payment Interface) platforms such as Google Pay and PhonePe causing concerns among authorities. Recently, a young woman in Maharashtra narrowly escaped falling victim to a fraudulent scheme. In a phone conversation with her father, they deliberated on handling expired LIC deposits. Subsequently, a call purportedly from LIC came to the woman urging a transfer of Rs 25,000 from her father's deposit.

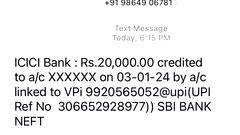

Given her father's unavailability on Google Pay, the scammer insisted on transferring the funds to the woman's UPI account, to which the father obliged by providing her number. Craftily, the scammer speaking in an affectionate manner also requested the woman's Google Pay details. Subsequently, a Google Pay message indicated two transactions: one of Rs 20,000 and another of Rs 50,000. The scammer alleged an error claiming that a Rs 5,000 transfer turned into Rs 50,000 and pressured the victim to return the excess Rs 45,000, accompanied by a falsified screenshot.

Fortunately, a last-minute scrutiny via Google Pay revealed that no actual transactions occurred, exposing the screenshot's falsification. Authorities from the Cyber Police are actively investigating the incident.

Several methods employed by scammers have surfaced, including:

1. Sending deceptive messages urging immediate payment of bills with a promise of cashback via a link, which, if clicked, installs malware leading to phone hacking.

2. Vulnerability of UPI ID and PIN numbers of users on public Wi-Fi networks to hacking.

3. Creation of fraudulent SIM cards to acquire access to victims' UPI accounts associated with their numbers.

In light of these escalating UPI scams, the Cyber Police urge the public to:

- Monitor transactions vigilantly.

- Safeguard UPI PINs without sharing them.

- Routinely change passwords.

- Conduct UPI transactions solely with trusted individuals.

- Report any suspicious activity promptly to the bank and authorities.

The Cyber Helpline Number is 1930. UPI scams have been on the rise, with reported cases increasing annually:

- 2020-2021: 77,000 cases

- 2021-2022: 84,000 cases

- 2022-2023: 95,000 cases

The Cyber Police emphasize vigilance among the populace to combat the growing threat of UPI scams in the state.

For more information and assistance, contact the Cyber Helpline number 1930.